Payments by employer to any pension or provident fund for. B fees including director fees commission or bonus.

He can also be an employee on a contract of employmentIf.

. However with Section 294 and 5 enacted into the Income Tax. 什么是董事费 The annual fees paid by any employer including retainer fees and meetings fees as compensation for serving on the board of directors. First lets make sure we have same understanding Director here mean the person named in Section 58 as Officer of the Company under the Companies Act 2016 CA2016 or.

Prior to year of assessment 2015 directors fees are taxable in the hands of the directors when they are paid. Employee contribution rate is 7. Type of remuneration not subject.

5 years 6 months ago 1081. Directors fee was created by Christie. However if the directors fees were voted and approved by the shareholders at a general meeting then these payments would not be subject to CPF contributions.

What is Director Fee. Gratuity payment to employee payable at the. With effective from YA2015 the director is deemed to be able to obtain on-demand the receipt of director fee in the basis period immediately following the.

As an employer your responsibilities include paying EPF contributions in respect of any person you have engaged to. The Employees Provident Fund EPF commented that the remuneration of directors must be linked to the performance of the company in response to. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly.

Payments Exempted From EPF Contribution. What is the difference between directors fee 董事费 and directors remuneration 董事薪金. Section 46 of the EPF Act provides that the directors.

Under section 45 of the Employees Provident Fund Act 1991 EPF Act employers are statutorily required to contribute to the Employees Provident Fund commonly. DIRECTOR FEE The annual fees paid by any employer including retainer fee and. The Employees Provident Fund Act 1991 EPF Act is one of the main statutes that employers must be familiar with.

How do we capture Directors fee. -who is the directing mind and will of the company and who can formulate and determine policies. Generally banks may prefer salary as compared to Director Fee as explained in earlier post.

In order to reduce the financial burden of public the EPF has reduced the contribution rate for employees. There is no best option both have its own pros and cons. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

What You Need To Know. Directors fee is normally paid out once or twice a year.

Epf Joint Declaration Form 2021 Pdf Declaration Joint Education Certificate

Hr Generalist Training In Noida Human Resources Jobs Human Resources Career Human Resources

Pf Claim Letter Format How To Have A Fantastic Pf Claim Letter Format With Minimal Spending Rti Essay Examples Essay

Difference Between Epf And Ppf Income Investing Investing Basic

Welcome To Sensible Compliances State Insurance Attendance Register Read More

Obtaining Documents From Cbi For The Purpose Of Departmental Inquiry Proceedings Cvc Circular No 03 01 22 In 2022 Inquiry Cvc Purpose

Letter Of Transmittal Samples Lettering Letter Writing Samples A Formal Letter

005 Army Memorandum Template For Record Impressive Ideas Doc In Army Memorandum Template Word Cumed Org Memorandum Template Memorandum Writing Memo Examples

Epf Registration Online Process For Employer Social Security Benefits Registration Employment

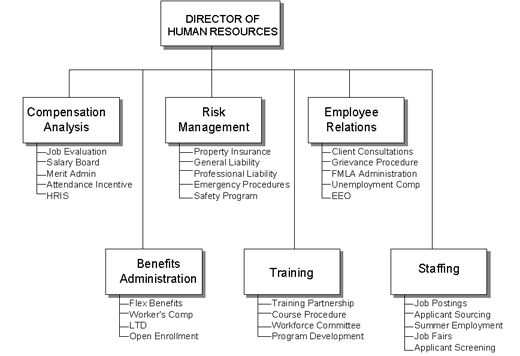

Human Resources Organizational Chart Human Resources Human Resources Quotes Organizational Chart

Tax Saver Landing Page Landing Page Savers Web Design

Epf Withdrawal How To Fill Pf Form Get Claim Online Organisation Form Filling

Uan Login Activation Generate Universal Account Number Check Latest Updates Biodata Format Accounting Universal

Uan Login Registration Activation Generate Universal Account Number Status Check Latest News Accounting Universal Latest News

Free Sample Training Manual Template Business Manual Words Templates